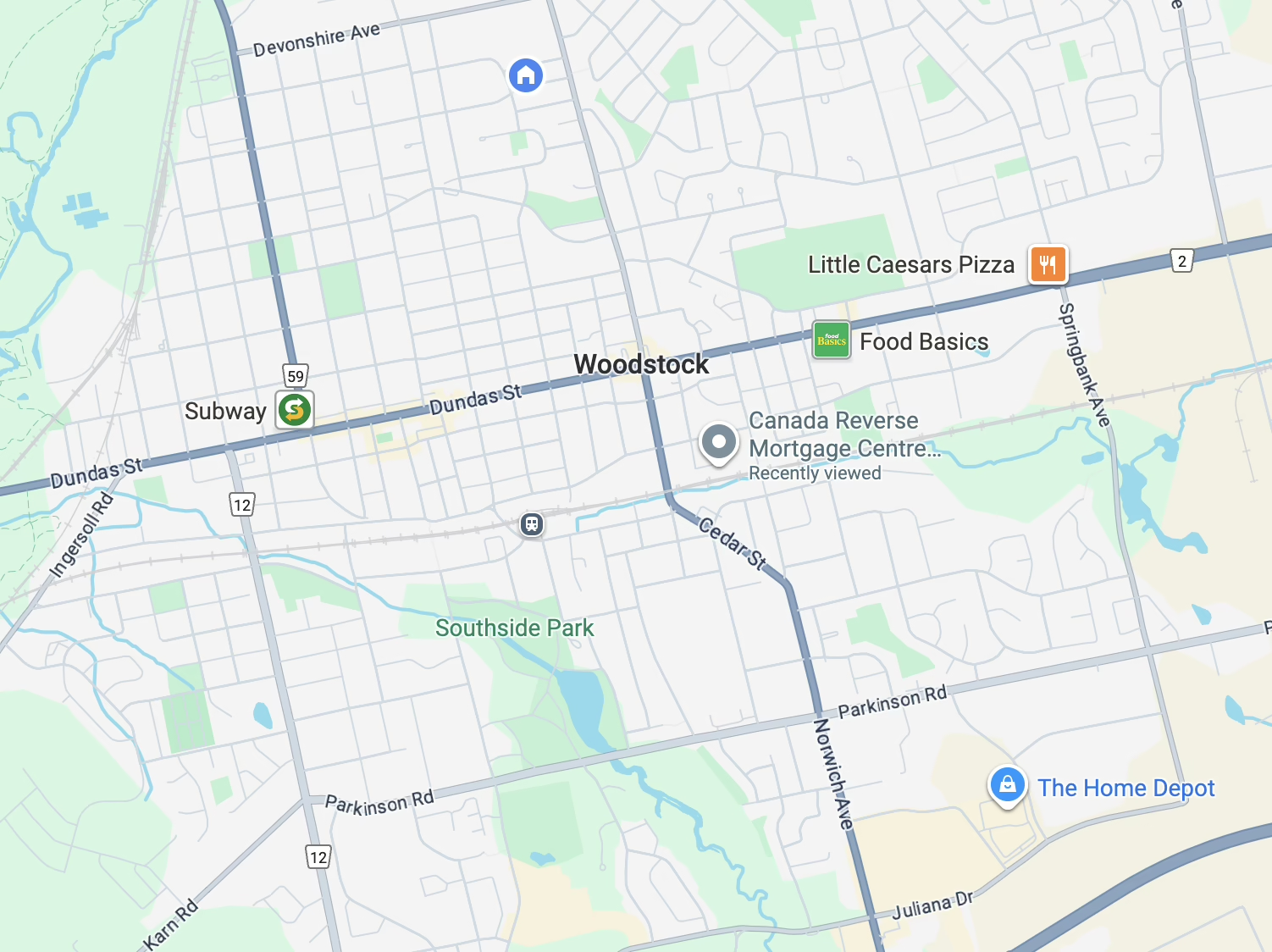

Talk With Our Reverse Mortgage Team Today

Before we get started:

- Reverse mortgages are available to Canadians 55+

- Reverse mortgages apply to properties that are currently valued at $200,000+

- We're committed to helping you find the right solution, even if that's not a reverse mortgage

The Most Common Questions About Reverse Mortgages in Canada:

91 Questions About Canadian Reverse Mortgages

You've got questions about reverse mortgages in Canada, and the good news is that we've got answers. Browse all of your questions about reverse mortgages, or use the table of contents if you have...

Top Canada Reverse Mortgage Myths Busted: Separating Fact from Fiction

Do reverse mortgages in Canada mean losing your home? Let’s bust this myth and more. In this no-nonsense guide, we dispel the top ‘Canada reverse mortgage myths’ to bring you the unvarnished truth....

Bloom Finance Reverse Mortgage vs CHIP Reverse Mortgage: Which is Best?

Are you trying to choose between a Bloom Finance reverse mortgage and a CHIP reverse mortgage? This article compares them head-to-head on loan amounts, interest rates, fees, and more to help you...

Unlocking Home Equity: How Does a Reverse Mortgage Work in Canada?

If you’re a homeowner over the age of 55 in Canada, understanding how a reverse mortgage works could unlock financial options for your retirement. A reverse mortgage allows you to convert part of...

HELOC vs Reverse Mortgage in Canada: Navigating the Best Options for Your Home Equity

Considering a HELOC or a reverse mortgage? This guide demystifies the heloc vs reverse mortgage dilemma by comparing key differences and helping you determine the right fit for leveraging your home...

Understanding the Reverse Mortgage: CHIP Pros and Cons

Are you a Canadian homeowner over 55, considering your financial options? A reverse mortgage might be your solution to accessing home equity without monthly payments. While there are multiple...